The holidays can be a magical time filled with family, fun, and festivities, but they can also create financial stress. Between gifts, travel, and gatherings, the holiday season can strain even the most well-planned budget. To help you stay on track, here are 10 practical holiday budgeting tips that will allow you to enjoy the season without the financial hangover.

1. Set a Holiday Budget Early

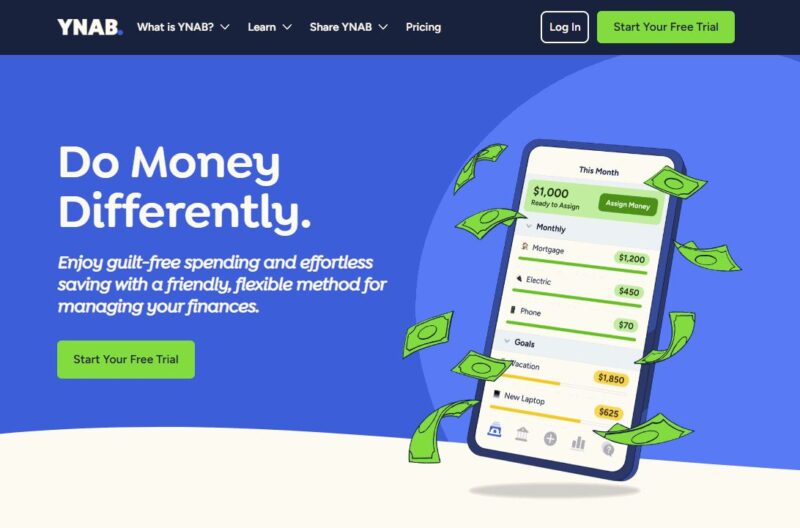

Start by creating a clear holiday budget. Allocate funds for different categories like gifts, food, decorations, and travel. Use budgeting apps like YNAB (You Need A Budget) or Mint to help you keep track of your spending.

2. Prioritize Spending

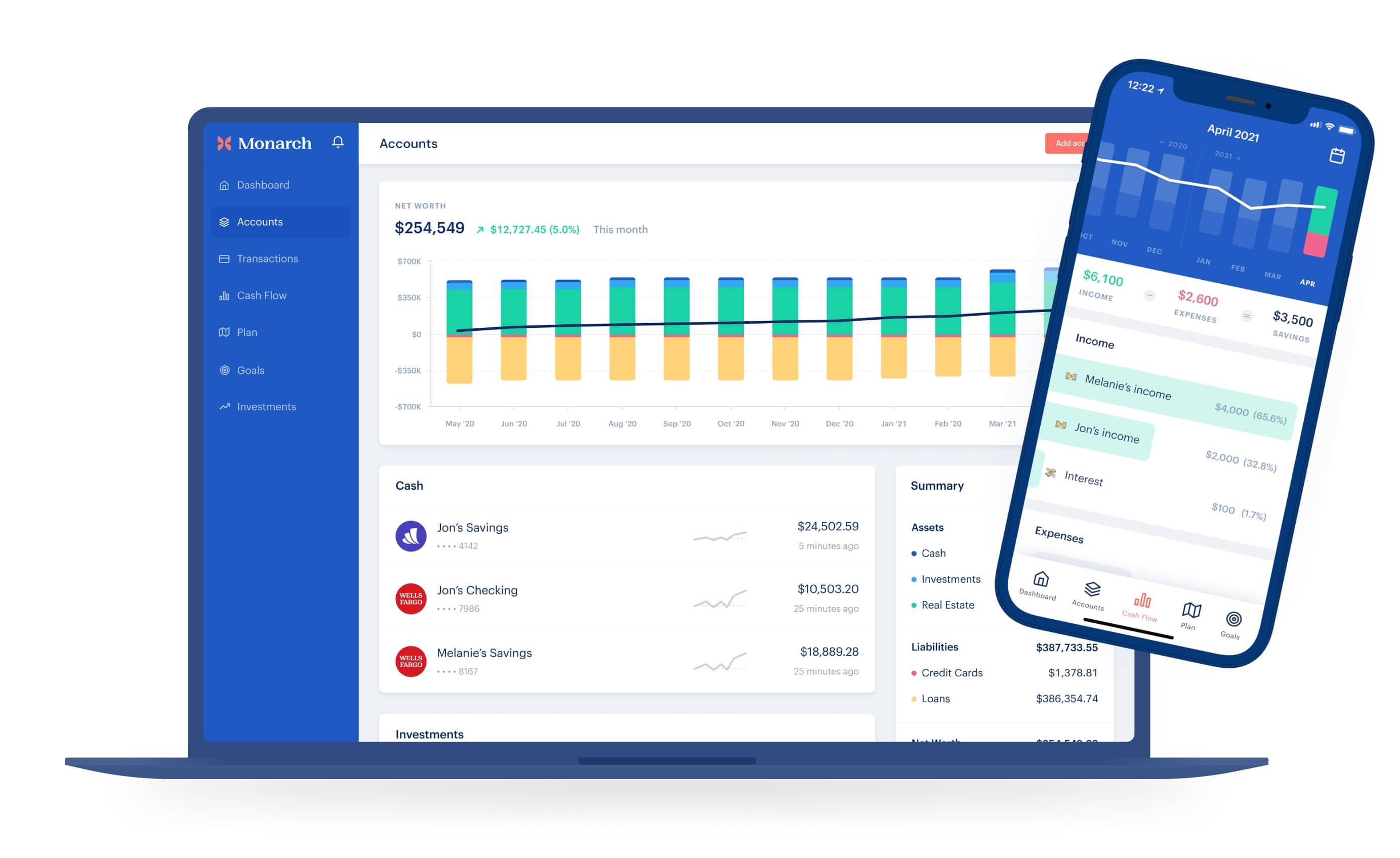

Decide early on what matters most to you. Is it buying special gifts for your kids? Hosting a family dinner? Prioritizing what’s most important will help you focus your spending on what brings the most joy. There are lots of apps to track your goals. For example, with Monarch, you can keep track of weekly and monthly expenses using Monarch’s budgeting tools to keep track of your finances.

3. Take Advantage of Cashback and Rewards Programs

Utilize cashback credit cards, loyalty programs, or apps like Rakuten and Honey to earn rewards while shopping. You can earn cash back on everything from gifts to groceries.

4. Spread Out Your Purchases

Don’t wait until the last minute to start shopping. Spread your purchases over a few weeks or months to avoid a massive hit to your bank account in December. Take advantage of sales like Black Friday or Cyber Monday.

5. Consider DIY Gifts

DIY gifts can be a great way to save money and add a personal touch. Get your kids involved in crafting handmade gifts or creating simple homemade presents. It’s budget-friendly and meaningful. Amazon and Etsy have a plethora of DIY gift kits that can be used for inspiration.

6. Host Potluck-Style Gatherings

If you’re hosting a holiday gathering, ask guests to contribute by bringing a dish. Potluck dinners are a great way to save on food expenses and bring everyone together. To make it even easier, you can use platforms like Instacart, Walmart Delivery, etc… to shop and have all the items for your holiday dishes dropped right at your doorstep.

7. Use Apps to Track Holiday Expenses

To ensure you don’t overspend, use apps like EveryDollar or Goodbudget to track every purchase you make. These tools will help you adjust your spending in real-time if you go over budget in one area.

8. Shop Secondhand for Holiday Décor

Thrift stores or online resale platforms like Facebook Marketplace or eBay can be great places to find affordable holiday décor. Often, you can find gently used items that look brand new for a fraction of the price.

9. Make Use of Free Holiday Events

Look for free local holiday events, like tree lightings, community parades, or school concerts, to entertain your family without spending a fortune. This helps maintain the holiday spirit without dipping into your wallet. Search Google for “local events near me” or use an app like Eventbrite to find events in your local area.

10. Start Saving for Next Year Now

Once the holidays are over, start saving for the next year. Set up a dedicated savings account and contribute to it monthly, so you’re prepared when the season rolls around again. Even small amounts can add up over time. Roth IRA is the golden egg of investing due to its tax advantages and long-term growth potential.

By following these 10 budgeting tips, you can ensure a financially stress-free holiday season while still creating joyful and memorable experiences with your family. Don’t forget to take advantage of the many tools and apps available to help you stick to your budget and avoid post-holiday financial strain!