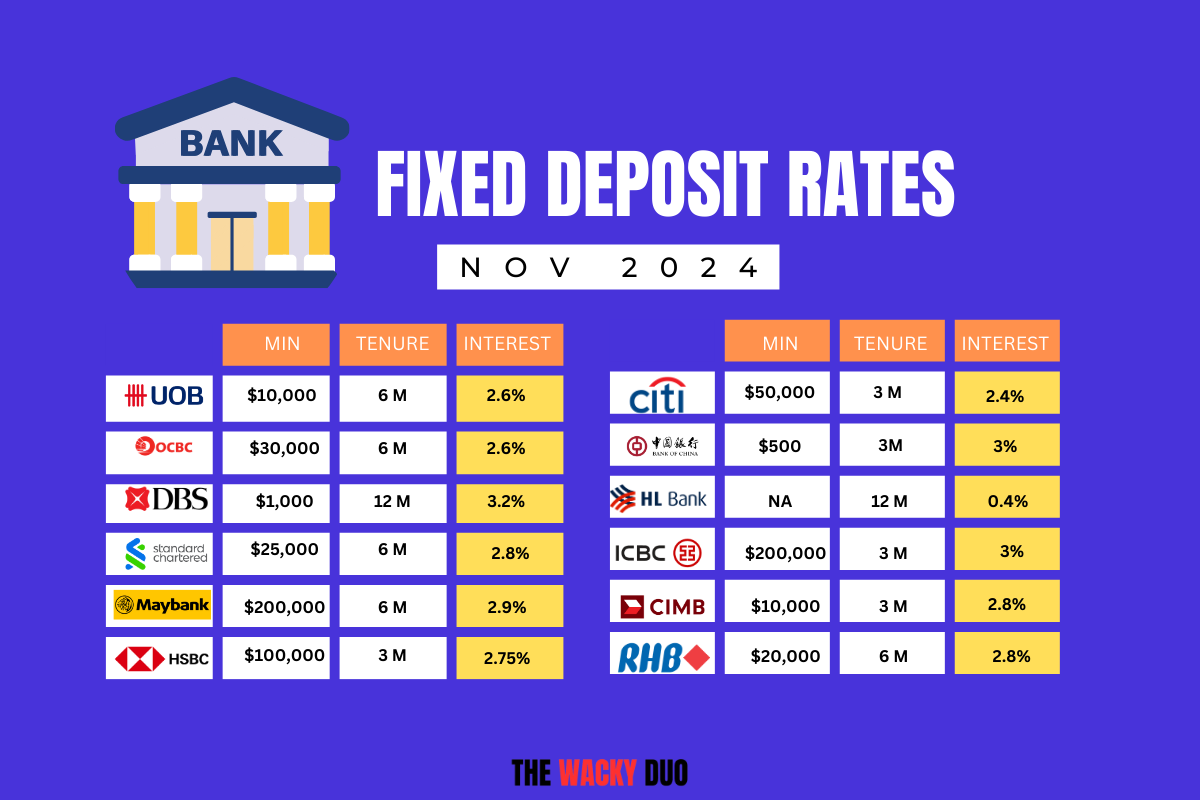

FD rates are now mostly 3% and below

With FOMC cutting rates last month, most banks’ FD rates continue to drop to

below 3 %.

There are the best interest rates for fixed deposits for banks in Singapore

for October 2024

|

BANKS |

INTEREST (PA) |

TENURE |

MIN DEPO |

|

BANK OF CHINA |

3.% (Online) |

3 mths |

$500 |

|

CIMB |

2.8% (Online) |

3 mths |

$10,000 |

|

CITIBANK |

2.4 % |

3 mths |

$50,000 |

|

DBS/POSB |

3.2%

|

12 mths |

$1,000 |

|

HL BANK |

0.4% |

12 mths |

NA |

|

HONG LEONG FINANCE |

2.75% |

3 mths |

$50,000 |

|

HSBC

|

2.75%

|

3 mths |

$100,000 |

|

ICBC

|

3% |

3 mths |

200K and above |

|

MAYBANK |

2.9% |

6 mths |

$200,000 |

|

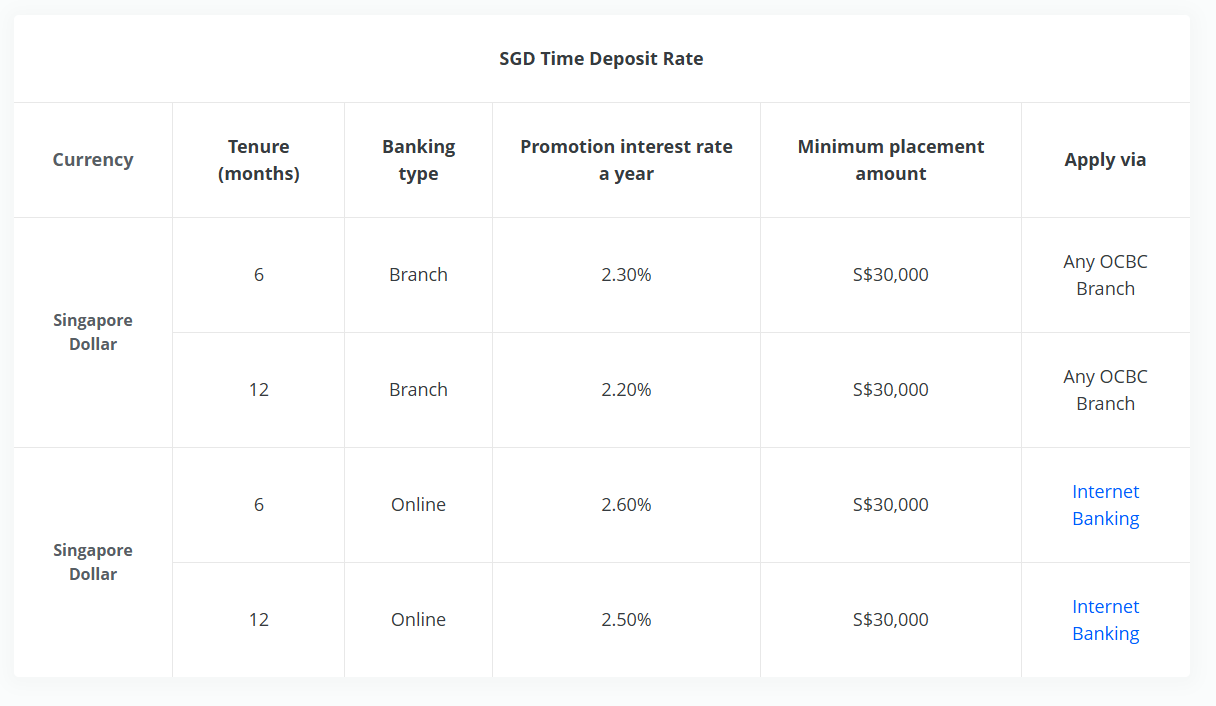

OCBC

|

2.6% (online) |

6 mths |

$30,000 |

|

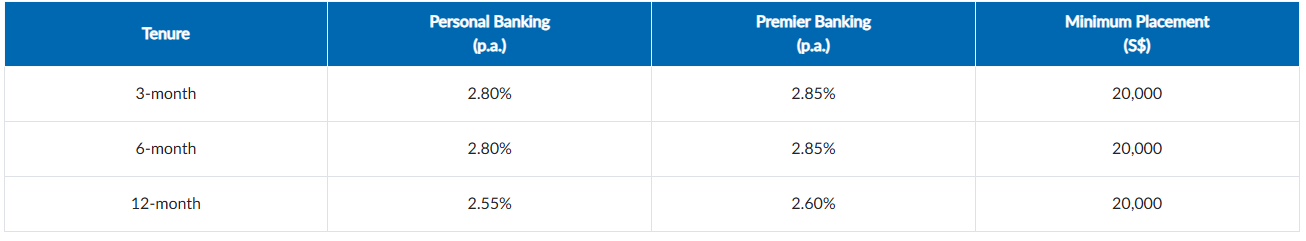

RHB

|

2.8% (Premier Banking)

|

6 mths |

$20,000 |

|

SINGAPURA FINANCE |

NA |

NA

|

NA |

|

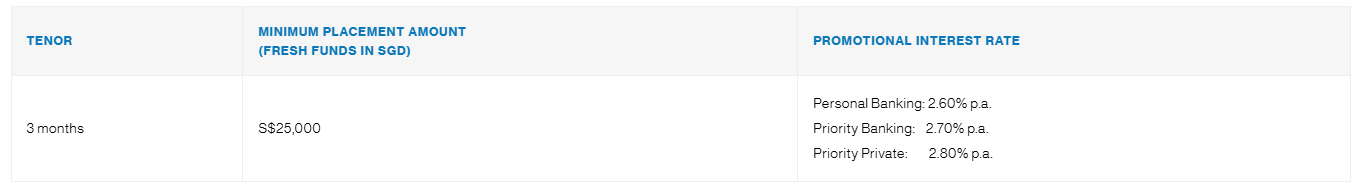

SCB

|

2.8% (Priority Private) |

6 mths |

$25,000 |

|

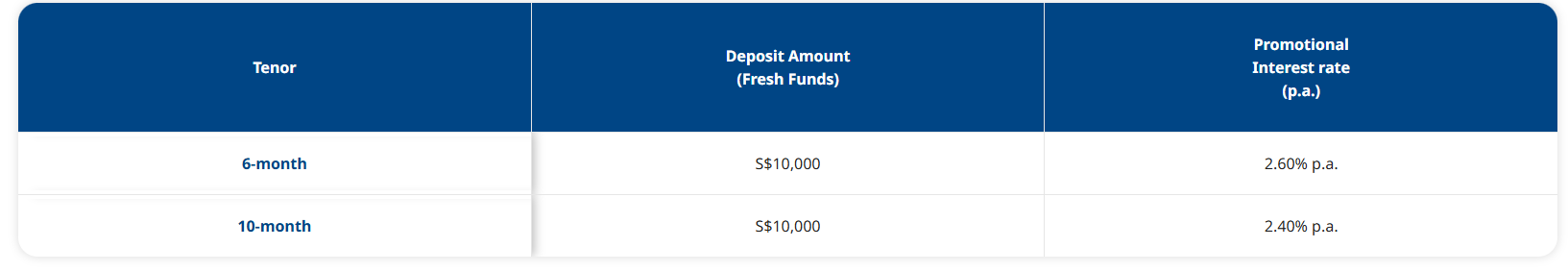

UOB

|

2.6% |

6 mths |

$10,000 |

*Click on the individual banks for the latest rates

Rates are as of 1 Dec 2023. Please refer to respective banks for the latest

rates

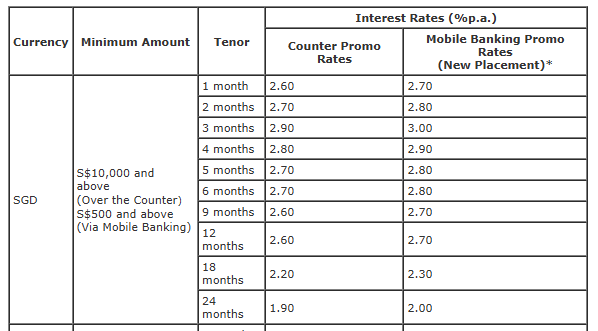

Bank of China

The best rate for BOC has dropped to 3% for 3 months via Mobile

Banking.

CIMB

CIMB’s best FD rate has fallen to 2.8% for 3 months.

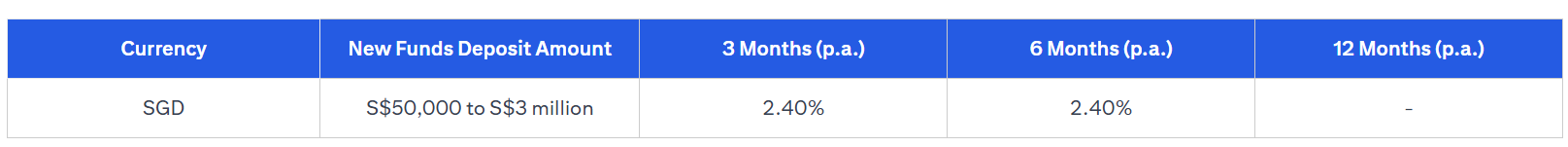

Citibank

Citibank’s FD rate is down to 2.4% for 3 months.

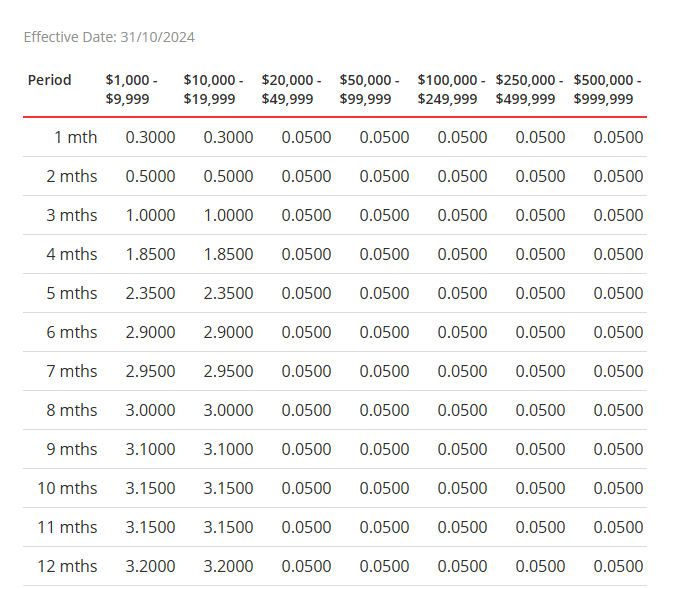

DBS / POSB

DBS/POSB remains at 3.2% for 1 year. As a result, it is now the bank with

the highest FD rates. Do note the cap of $19,999 to qualify for these

rates.

According to their website, DBS/POSB will accept new placements for tenors

12 months and below.

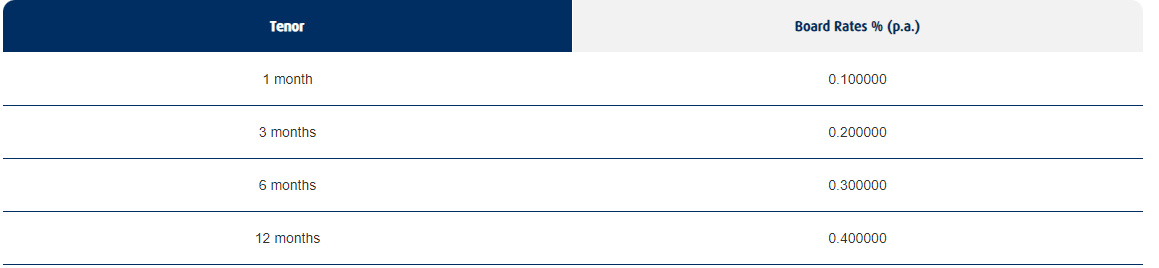

HL Bank

Based on HL Bank website, only board rates are offered

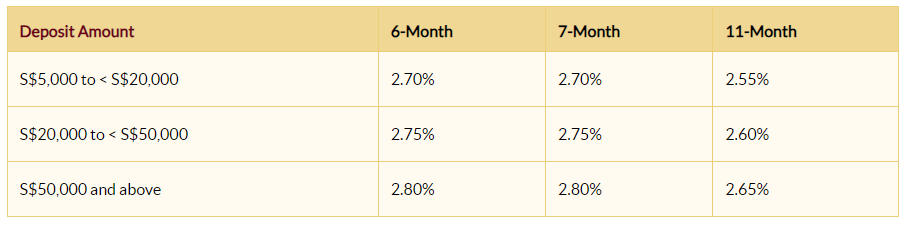

Hong Leong Finance

Hong Leong Finance highest FD rate is at 2.8% for 6 months.

HSBC

HSBC highest FD rates drops to 2.75% for 3 months for more than

$100,000.

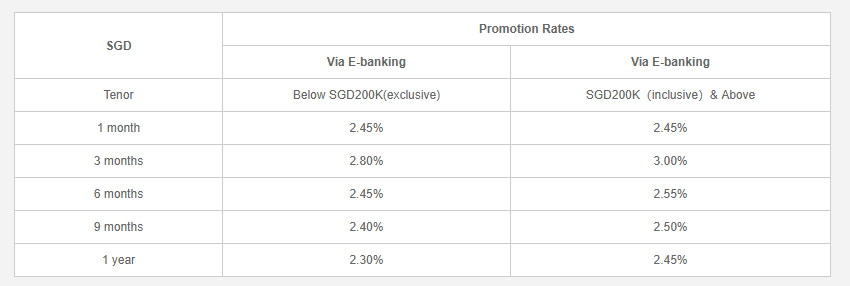

ICBC

ICBC offers 3% for 3 months . The minimum is at 200K and above and

the transaction has to be done via banking.

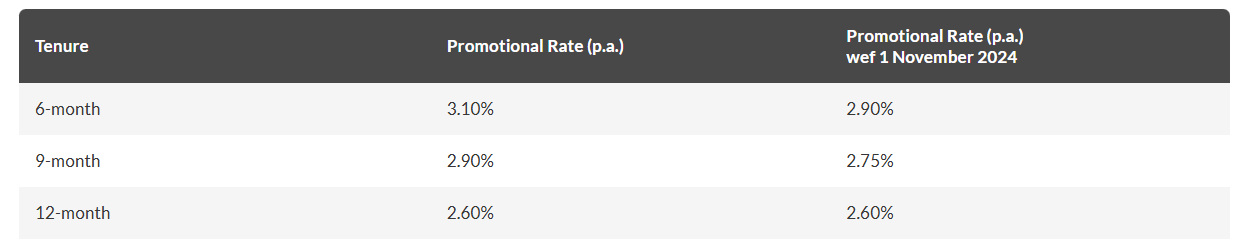

Maybank

Maybank’s best FD rate drops to 2.9% for 6 months. This is for

online placement with a minimum of $200K

OCBC

OCBC FD rate is at 2.9% for 6 months online

RHB

RHB best rate is for 2.85% for 3 months. The minimum placement is $20K for

Premier Banking.

Standard Chartered Bank

SCB offers a tier rate promotion. The highest is 2.8% for 3 months for

Priority Private.

UOB

UOB FD rates is one of the lowest at 2.6% for 6 months

Disclaimer

The information provided by TWD is for information purposes only and is

not meant to be investment advice. Readers must do their due diligence and

consult financial advisors for their investment needs. The information is

correct as of 31 Oct 2024